Many common questions are answered below. Just select the topic and question that best fits your need.

If you are unable to find an answer below, we’re here to help. Just contact us.

If your employer participates in a direct deposit program, simply provide our routing and transit number and your account number to the human resources or payroll department at your company, and your direct deposit will usually begin within thirty days.

Simply contact the Social Security Administration at 1-800-772-1213 (TTY 1-800-325-0778) and provide them with our routing and transit number and your account number. Or visit them online.

211371489

Account information is available with our Customer Service Representatives during business hours at any of our offices or you can call Telephone Banking for automated account information 24 hours a day.

At this time, we only accept applications from persons residing within the United States with valid U.S. tax identification numbers (Social Security Numbers). If you have questions, contact us. We’d like to hear from you.

Thanks to the convenience of Online & Mobile Banking, Direct Deposit, and ATMs, everyday banking activities can be performed on your own time. Contact us with questions about your banking needs.

With Online & Mobile Banking, you have access to your account information 24 hours a day, 7 days a week!

Your account information is updated every business day with new transactions that posted to your account the previous day.

Funds can be transferred to and from accounts by wire transfer or via ACH (Automated Clearing House) debits or credits. Contact us for details.

You can do most of your banking by using Mobile Banking, direct deposit, ATMs or ACH (Automated Clearing House) transactions. We also offer a bank-by-mail service, which allows you to mail non-recurring deposits. Our Mobile Check Deposit and Deposit XPress services allow individuals and businesses a fast and easy way to make deposits of checks remotely from a mobile device or from their place of business using their PC and a special check scanner. Contact us for details on a method that’s best for you.

You can view account balances and transaction history, transfer money, pay bills and download transactions to financial software and much more.

For complete information on creating secure login information, learn more here.

Your account information is updated every business day with new transactions that were posted to your account the previous business day.

You can access your checking, savings, and loan accounts from Online & Mobile Banking. They are intended to give you as much access, security, and versatility as possible.

Online Banking supports downloads to Quicken® (QFX), QuickBooks® (QBO or IIF) and will also export file formats for personal finance (QIF), spreadsheet (CSV), or word processing (txt).

Yes, you can schedule immediate, future, and recurring transfers.

The inactivity time-out default is set for 10 minutes.

Just call our Customer Service Center at 877-668-2265 and we will take you through the steps needed to log in to Online & Mobile Banking. Personal banking customer may also use the “forgot?” link to reset their password on their own.

Steps to enroll in Bill Pay:

For Personal Online Banking:

For Business Online Banking:

Yes. You can schedule weekly, semi-monthly and monthly recurring payments.

When you update the information for the bill payment account, the changes are immediate.

Only checking accounts can be used for bill payment purposes. You can add multiple checking accounts to Bill Pay and choose the accounts from which payments are drawn.

If you need assistance adding accounts, please call our Customer Service Center at 877-668-2265.

You can begin using Bill Pay as soon as you have logged in to Online & Mobile Banking for the first time.

To add a new payee:

Please note, if adding a business or utility, please be sure to enter the account and address information from your most recent bill.

Anyone or any entity in the 50 United States and territories who can accept a check can be paid using Bill Pay. However, tax payments (such as federal, state and local) and court directed payments (such as alimony and child support) cannot be processed through Bill Pay.

You can set up your payments during the weekend. However, the system will prohibit you from scheduling a single payment and the first of a recurring payment on the same weekend. When scheduling payments on a weekend, the first day for which you can schedule payments (single or recurring) is the first business day following the weekend.

Each bill payment is debited separately.

We are able to pay many payees electronically. In these cases, the funds are withdrawn from your account when your payment is issued. If we are unable to issue the payment electronically, a paper check is issued which will debit your account when it has been deposited by the payee and cleared.

Automated Clearing House is a funds transfer system which provides for the interbank clearing of electronic entries for participating financial institutions.

No. In some cases – often when paying an individual – a payee may not be able to accept ACH payments. In such cases the Bill Pay system creates a paper check that is mailed to your payee. When a paper check is mailed, your account is debited for the amount of the check when the check is deposited by your payee.

If you select an electronic payee with an address that is different from that indicated on the payment coupon, you are responsible for the late fee. You always have the option to manually enter a different address for a payee.

Payments can be cancelled by 3:00 pm on the day they are scheduled to be sent.

Once an electronic payment has been issued, it cannot be stopped. If an electronic payment was made in error, we would recommend contacting the payee to request a refund.

Payments issued as a paper checks can be stopped after they are issued. If you wish to stop payment on a check you may do so either within Online & Mobile Banking or by giving us a call at 877-668-2265.

It is a fast, easy and secure way to deposit checks via your mobile device.

First, you need to be an Online & Mobile Banking user and have downloaded our Mobile app. Once you’ve logged into Mobile Banking, choose Deposit check to enroll. (Please allow up to two business days for enrollment to be complete.)

All currently supported iPhone,® iPad ® and AndroidTM mobile devices may be used.

No, however activation could take up to two business days.

You can make deposits to any Brookline Bank Checking, Savings or Money Market Account that you have selected to view on Mobile Banking.

No.

It’s easy. Just follow these steps:

Mobile deposits confirmed as received before 7:00 p.m. ET on Monday through Friday (except Bank Holidays) will be considered deposited on that day. Deposits confirmed as received after 7:00 p.m. ET on Monday through Friday (except Bank Holidays) will be considered deposited on the next Business Day.

Deposits entered before 7 pm ET on a business day will be processed same-day. Deposits entered after that time or on a non-business day will be processed the next business day and will reflect in your account the following day.

Pending Mobile Check Deposits will not be listed in your transaction history. To confirm the deposit is in-process, you can select “Recent activity” on the “Deposit Checks” page. You will see the deposit listed in your account transaction history once the deposit has been processed.

You should keep the original check for 30 days after depositing it. To avoid re-depositing it by mistake, consider writing “Mobile Deposit” on the front of the check as a reminder to yourself.

Checks payable in U.S. dollars and drawn at any U.S. bank, including personal, business and government checks, are eligible as long as they are payable to and endorsed by the account holder.

International checks, U.S. savings bonds, money orders, remotely created checks, convenience checks (checks drawn against a line of credit) and checks made out to cash are not allowable. For a complete listing of ineligible checks, please see our Online Banking Agreement.

You must have one or more eligible checking or savings account(s) that have been open and in good standing. If you have had any nonsufficient funds occurrences during a rolling 90 day period you will not be eligible to use this service. If, after a ninety day period you have not had any nonsufficient funds occurrences you may re-apply.

Poor image quality is the most common reason a check cannot be read. If you have deposited a check through Mobile Check Deposit that has been returned, please call us at 877-668-2265.

Our mobile banking processor is located in the central time zone, therefore your confirmation references Central Time. Please add an hour for Eastern Time.

eStatements are a service that allows you to view your monthly statements and year-end tax forms from Online & Mobile Banking. The online versions replace the mailed, paper versions and are, environmentally friendly, secure, easily accessible, fast, and free.

In order to receive eStatements you need to be enrolled and active in our Online & Mobile Banking service. You will select Documents within the account for which you want to receive the eStatement. You will receive a confirmation email from us when your enrollment has been completed.

When your statement is ready, you’ll receive a courtesy email letting you know that your eStatement is available for viewing. To access your statement, log on to Online or Mobile Banking, and select the account for the statement you want to view. It’s that quick and easy!

No, once you have completed the enrollment process, paper statements are no longer produced for your account(s).

All of your deposit accounts (with the exception of Certificates of Deposit) and credit accounts are available for eStatements.

Once you sign up, you’ll be able to view up to seven years of eStatements.

If you are viewing your eStatements from a laptop or desktop computer, and you have a printer, you can print your eStatements documents directly from your browser.

Yes, in fact, we recommend that you save your monthly statements on your computer, a flash drive, or other storage device so you can easily retrieve them in the future. To save a copy of your eStatement, or online tax forms open the pdf, choose “File” then “Save As” and specify where you want the document saved on your storage device.

If you do not receive your eStatement notification when it is normally sent, please check to be sure your email mailbox is not full and that your email address has not changed. You should also make sure that the email address we use to send your eStatement notifications does not block certain emails as SPAM or “Junk Mail.”

You can cancel your eStatements delivery at any time. To do so, log in to Online or Mobile Banking, click the account you wish to unenroll, select Settings, then Documents/Enrolled. You may then de-select the checkbox and click Save. Or, you may write to us at Brookline Bank, eStatements, P.O. Box 470469, Brookline, MA 02447-0469, call our Customer Service Center at 877-668-2265, or send us a secure message via Online or Mobile Banking.

There is no deadline for enrolling in tax forms. Once you sign up, you’ll be able to view up to seven (7) years of tax forms.

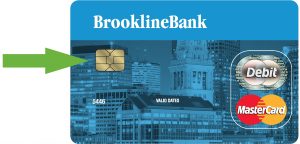

EMV stands for Europay, MasterCard®, Visa. It is an international standard for credit and debit cards equipped with computer chips and the technology used to authenticate chip-card transactions. To help stop the ever increasing risk of large scale data breaches and counterfeit card fraud, U.S. banks and other card issuers are migrating to this technology to protect consumers and reduce the costs associated with fraud. EMV chip cards are currently widely used in Europe, Asia and Canada, and are now being adopted in the U.S.

An EMV chip debit card has a microchip embedded in it that provides substantially more security than a magnetic stripe.

EMV cards are referred to as chip cards. The small metallic square you’ll see on new cards is a microcomputer.

The magnetic-striped cards in use for years store static data, or payment data that does not change. The data stored in the magnetic stripe includes your 16-digit card account number, expiration date and 3-digit security code (CVC) like the one found on the back of your card. EMV Chip cards contain the same data and more. Each purchase or transaction that you make with your card generates dynamic or unique data that is encoded in a safe mode.

EMV helps protect you even if your card or your card data is lost or stolen because the chip technology:

The process for using a chip card is different than using a magnetic stripe card. Instead of swiping, you insert the card into the merchant’s card reader and leave it there. You then follow the prompts on the card reader’s screen and wait to remove the card until the transaction has completed. Be careful not to leave the card behind!

It may take some time to become used to the chip card, but the extra security provided will be well worth the transition from swiping to dipping.

The verification method for your Brookline Bank debit card is referred to as chip-and-signature. In many cases you will use a signature or PIN the way you do today. If the merchant prefers to ask for a PIN, you may be asked to enter your PIN for transactions that today require a signature, such as to pay a restaurant bill.

Yes. The initial EMV cards will include both chip and magnetic stripe functions. The card reader will guide you through the process:

Yes, the customer still has zero liability, even with an EMV chip enabled card.

No, not right away. Experts estimate that it may take up to four years for all financial institutions and merchants to fully convert to EMV chip technology. Initial use of both magnetic stripes and EMV chips provides significantly increased security but is easier on customers and merchants than eliminating magnetic stripes all at once.